The time commitment to train and retrain staff to update inventory is considerable. In addition, since there are fewer physical counts of inventory, the figures recorded in the system may be drastically different from inventory levels in the actual warehouse. A company may not have correct inventory stock and could make financial decisions based on incorrect data. Under periodic inventory procedure, the Merchandise Inventory account is updated periodically after a physical count has been made.

2 Perpetual v. Periodic Inventory Systems

To ensure they never run out of supply, sophisticated firms may set up automatic reordering. The continuing data assists firms in maintaining more detailed data on cost per item sold, which plays a significant role in profit margins and overall profitability. Operating using a periodic inventory method is like running your firm while wearing blinders for huge businesses or developing enterprises.

Sale of Merchandise

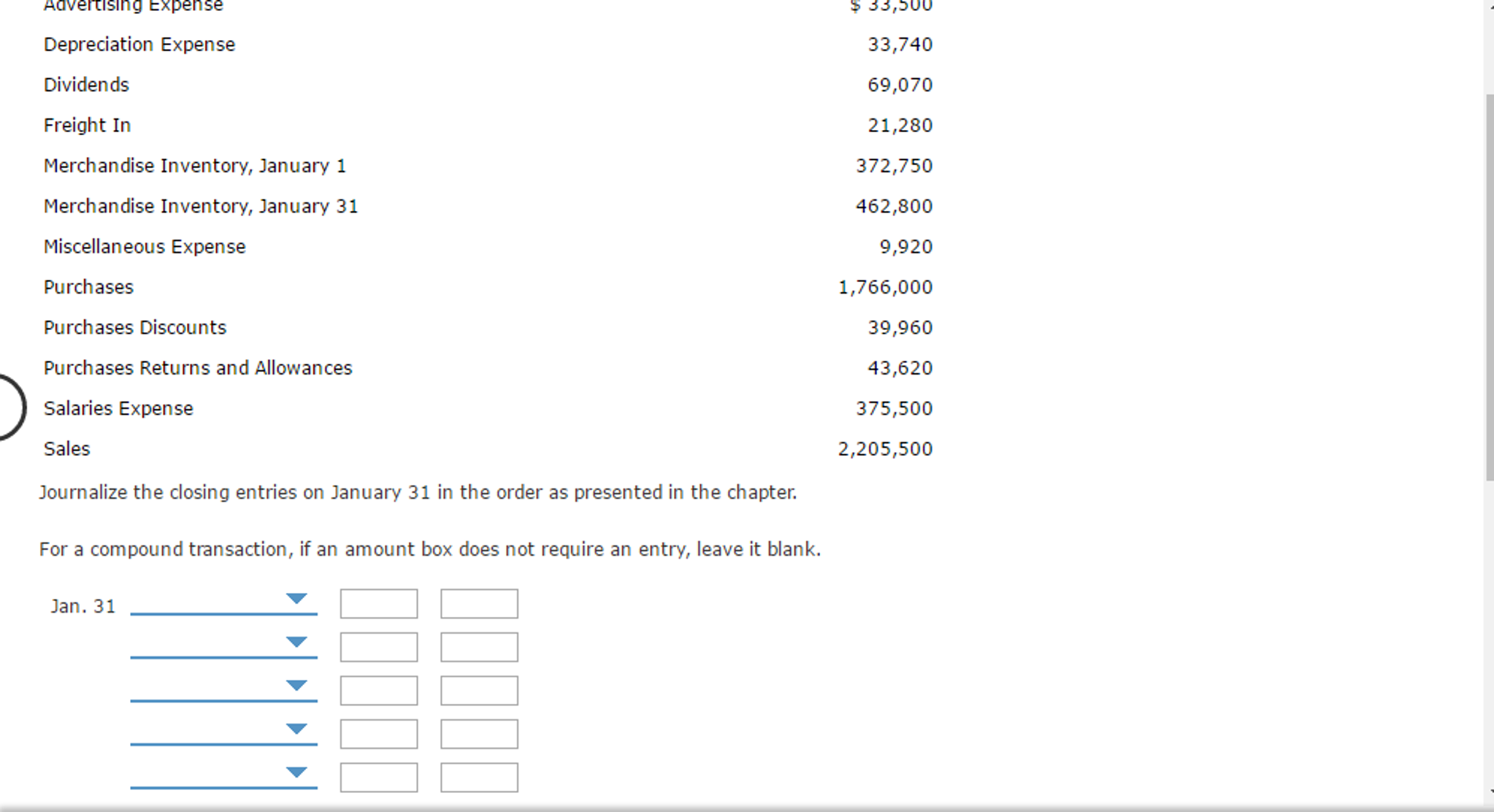

Complete the closing entry at the end of the accounting period, after the physical count. You can calculate the COGS by using a balancing figure or the COGS formula. In this entry, the debits are in the ending inventory rows and the COGS row, and the credits are in the beginning inventory and the purchases rows. Get an accurate view of your company’s financial health with Skynova’s all-in-one invoicing and accounting software.

What is Qualified Business Income?

- You just need a team to conduct the physical inventory count and an accounting mechanism to calculate the cost of shutting inventory to deploy a periodic inventory system.

- It requires less effort to set up and maintain than other inventory systems, making it an attractive option for many businesses.

- Small merchandising businesses can track their inventory with an inventory management approach known as the periodic inventory system.

- However, there is no way to consider these unforeseen changes with the periodic inventory.

- It makes sense when we look at the formula, the beginning balance plus new purchase less ending must result as the sold item.

By regularly assessing stock levels and recording them accurately, businesses can save time and money. However, periodic inventory systems are less accurate than perpetual inventory systems, making it more difficult to analyze stock levels. In addition, periodic inventory systems have a higher risk of theft as stock levels are not constantly monitored.

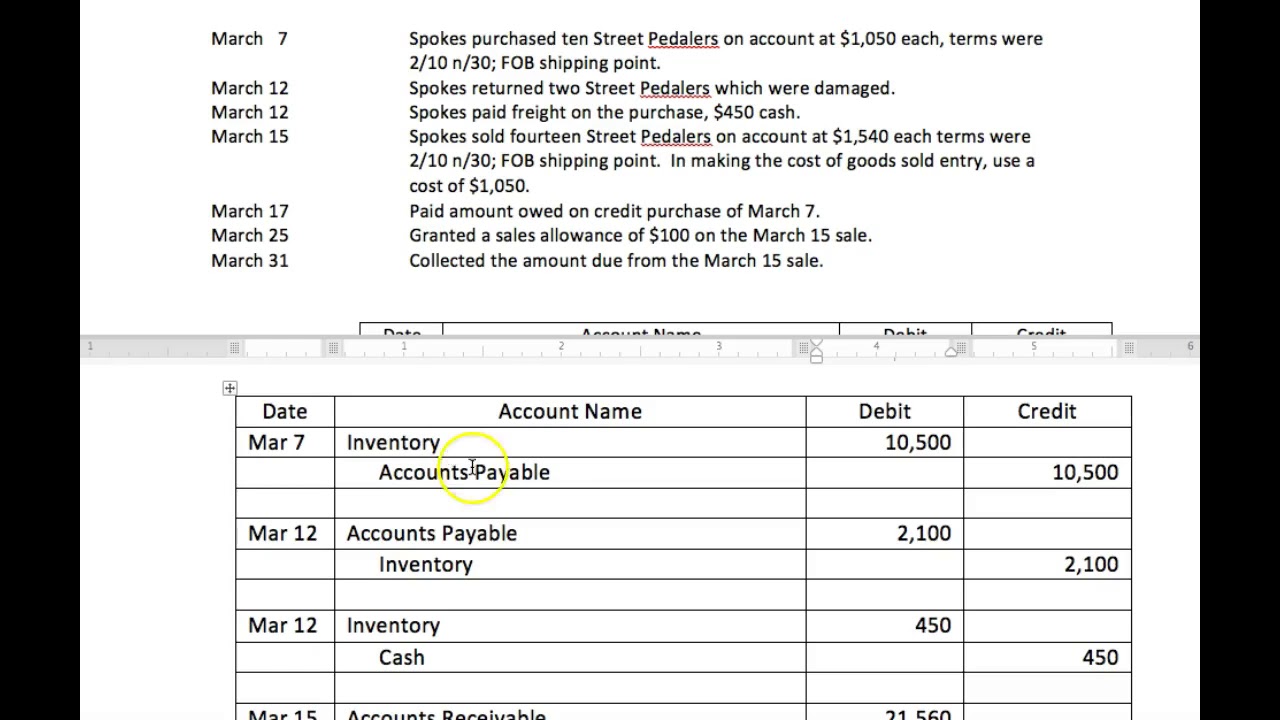

5: Buyer Entries under Periodic Inventory System

This method is often used by small businesses and those with low-volume sales as it is easier and more cost-effective to implement than a perpetual inventory system. The transaction will increase the inventory balance as the purchase account is under the inventory account. If there are purchase returns and purchase discounts, the company has to reduce the purchase account. The journal entry is debiting accounts payable and credit purchase accounts. The perpetual inventory system gives real-time updates and keeps a constant flow of inventory information available for decision-makers.

It’s crucial to note that both approaches are recognised by the General Accepted Accounting Principles (GAAP). This section will cover how the two systems differ and which approach is most appropriate based on your company’s business strategy. A periodic inventory system might work for companies with a single location or few product lines. Estimating the current inventory levels and keeping track of sale transactions are relatively simple tasks. A straightforward inventory system will also be simpler to administer and keep up with over time.

A company will choose the software based on its needs and the requirements of its products. With the periodic inventory system, you set a predetermined time frame to physically count your inventory. After each count or at the end of the year, you take the ending inventory balance and update your cost of goods sold (COGS).

However, the need for frequent physical counts of inventory can suspend business operations each time this is done. There are more chances for shrinkage, damaged, or obsolete merchandise because inventory is not constantly monitored. Since there whats the difference between a sales order and an invoice is no constant monitoring, it may be more difficult to make in-the-moment business decisions about inventory needs. The example below has the same activities as above, except the company tracks each unit individually and what it purchased.

A temporary account for purchases in a periodic system serves as the foundation for inventory accounting. There are some key differences between perpetual and periodic inventory systems. When a company uses the perpetual inventory system and makes a purchase, they will automatically update the Merchandise Inventory account. Under a periodic inventory system, Purchases will be updated, while Merchandise Inventory will remain unchanged until the company counts and verifies its inventory balance.

In a perpetual system, the COGS account is current after each sale, even between the traditional accounting periods. In the periodic system, you only perform the COGS during the accounting period. Under a periodic review inventory system, the accounting practices are different than with a perpetual review system. To calculate the amount at the end of the year for periodic inventory, the company performs a physical count of stock.

Leave a Comment