A buyers looking home financing has several alternatives. They could check out a community financial otherwise borrowing connection, check out a primary lending company instance Quicken Fund, otherwise attempt to obtain several mortgage also offers simultaneously by using a beneficial webpages for example LendingTree.

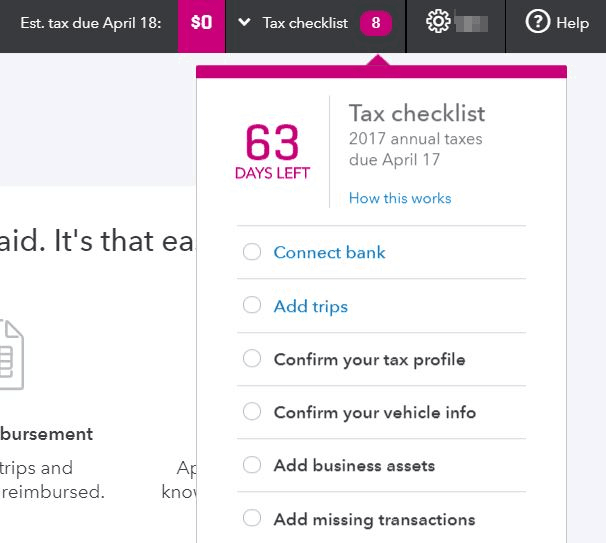

For folks seeking comparison shop because of their home loan during the relatively little time, this new LendingTree station is just one you could consider. The company does not provide mortgage loans alone but alternatively will act as a lead generator to possess an enormous selection of loan providers in circle. Whenever creditworthy users fill in its obtain that loan, he is gonna obtain has the benefit of away from a handful of people playing loan providers within seconds.

Providing you can navigate the process-which will keep lenders out of contacting and you can emailing one to safer your online business-it is an easy cure for see what rates you be eligible for so you can potentially go-ahead which have a formal loan application.

trick takeaways

- LendingTree try a third-class solution that takes a borrower’s suggestions and you may submits it so you can multiple lenders, whom after that get in touch with the newest debtor.

- A borrower submits a https://paydayloanalabama.com/margaret/ credit card applicatoin having information about its financials. LendingTree gets the FICO score right after which delivers the program so you’re able to financial institutions in their system whom focus on people thereupon amount of creditworthiness.

- LendingTree allows you to compare loan terms and conditions and then have loan providers in order to compete for your business.

- Specific individuals grumble of getting flooded that have phone calls otherwise characters, whilst company says you might do something to help you decrease that result by simply withholding their contact number when typing your own advice.

What’s LendingTree?

LendingTree isnt a mortgage provider, neither is it an agent. Such as for instance an agent, the organization connects users which have multiple banking institutions and you can collectors. However, LendingTree cannot direct your from the financial processes such as for instance an agent do, but alternatively functions as a lead-age bracket unit which allows loan providers to essentially bid towards the homeowners and you may refinancers just who complement its requirements. Nor does it ask you for since the a share of the amount borrowed while the an agent do.

Established during the 1996, LendingTree makes reference to in itself because the a keen « on the web lending areas. » The platform lets users to get in touch that have numerous mortgage operators so you can look for maximum words for various fund, credit cards, put levels, and you will insurance. It entails the fresh borrower’s financial request and you may submits they so you’re able to multiple financial institutions and financial organizations within the huge system (it work the same setting for automobile financing, unsecured loans, and various other borrowing products). These firms then contend into the borrower’s business. LendingTree’s selling point is the fact race pushes off prices, therefore mortgage bankers and agents technically bring straight down costs and you will costs when they learn he or she is directly in competition with lots of someone else.

How the LendingTree Techniques Functions

The first step so you can obtaining an excellent LendingTree financial is always to submit that loan demand, sometimes toward organizations website otherwise by the contacting their 800 matter. You are expected a few questions about the quantity and type off financing you will be trying to (particularly buy, re-finance, home equity, or reverse mortgage) along with factual statements about your income, possessions, and expense. LendingTree plus wants the Personal Shelter amount, that organization uses to track down your credit score thru an effective mellow credit pull.

It’s important to keep in mind that the information you render LendingTree really does maybe not create a formal app (that is complete courtesy among lenders, should you deal with a deal). Because a credit marketplace, the firm will not make approval decisions by itself. As an alternative, it tickets your data collectively to help you their circle out of loan providers, just who decide whether or not to expand an offer centered on its loan conditions.

Leave a Comment