Revenue per download can be calculated by dividing total revenue by the number of downloads. Fixed costs include expenses that do not change with the number of downloads, such as development, marketing, and server maintenance fees. Imagine you are developing a mobile app and want to calculate the break-even point in terms of downloads. A break-even analysis allows you to determine your break-even point.

Additional Business Services

One of the many challenges of being a small business owner is making sure your revenue at least balances out your expenses. After months, if not years of investment, you want your business to sustain itself with its own money. Having a successful business can be easier and more achievable when you have this information. It makes the difference from operating at a loss to achieving financial goals and expanding production. Where the contribution margin ratio is equal to the contribution margin divided by the revenue.

Why Is the Contribution Margin Important in Break-Even Analysis?

You probably never thought much about your roof, but it makes a big difference in how your solar investment will play out. If your roof has room for lots of panels that soak in the sun all day, you’ll produce a ton of electricity and see a quicker payback. If you live on a shady lot, and your panels’ production is more intermittent, you won’t see a payback quite as quickly. Marketing costs are a significant component of fixed costs and can influence the number of downloads needed to break even. Next, determine your variable costs per download, which might include server costs, payment processing fees, and customer support. Variable Costs per Unit- Variable costs are costs directly tied to the production of a product, like labor hired to make that product, or materials used.

Is my cost per unit sustainable?

This involves calculating the contribution margin per product (selling price minus variable cost) to determine how much each unit contributes to covering fixed costs. For instance, if management decided to increase the sales price of the couches in our example by $50, it would have a drastic impact on the number of units required to sell before profitability. They can also change the variable costs for each unit by adding more automation to the production process. Lower variable costs equate to greater profits per unit and reduce the total number that must be produced. Production managers and executives have to be keenly aware of their level of sales and how close they are to covering fixed and variable costs at all times. That’s why they constantly try to change elements in the formulas reduce the number of units need to produce and increase profitability.

Importance of Break-Even Point Analysis

- I began in the banking sector, gaining valuable insights into finance over five years.

- This is the price of raw materials, labor, and distribution for the goods or service you sell.

- Fixed costs are costs that do not change based on your production or sales volume (e.g., rent, insurance, and salaries).

- This break-even calculator allows you to perform a task crucial to any entrepreneurial endeavor.

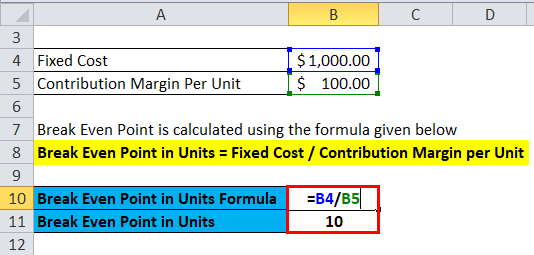

- The break-even point is calculated by dividing your fixed costs by the difference between the sales price per unit and the variable cost per unit.

In other words, it is used to assess at what point a project will become profitable by equating the total revenue with the total expense. Another very important aspect that needs to address is whether the products under consideration will be successful in the market. First we need to calculate the break-even point per unit, so we will divide the $500,000 of fixed costs by the $200 contribution margin per unit ($500 – $300). The break even analysis helps you calculate out your break-even point. Break-even analysis helps businesses choose pricing strategies, and manage costs and operations. In stock and options trading, break-even analysis helps determine the minimum price movements required to cover trading costs and make a profit.

Book a demo with our friendly team of experts

Once you crunch the numbers, you might find that you have to sell a lot more products than you realized to break even. While break-even analysis is a powerful tool for understanding costs and sales dynamics, several additional factors must be considered for a more comprehensive financial evaluation. This means you need to sell approximately 769 units to cover your costs.

The higher the variable costs, the greater the total sales needed to break even. Although investors may not be interested in an individual company’s break-even analysis of production, they may use the calculation to determine at what price they will break even on a trade or investment. The calculation is useful when trading in or creating a strategy to buy options or a fixed-income security product. Sometimes rooftop solar can completely cover your electricity needs — reducing your utility bill to $0 — and sometimes it only covers a portion of it. If you consume a lot of electricity, solar might only translate to a small reduction in your electricity costs, which means it could take longer for you to see a return on your investment. That’s why it’s important to think about your home’s energy efficiency before you consider solar panels — you can save money on energy and get a smaller solar panel system.

Remember, your fixed costs are the expenses that stay the same no matter how many units you sell. Variable costs, on the other hand, change based on the number of units sold. That’s the difference between the number of units required to meet a profit goal and the required units that must be sold to cover the expenses. In our example, Barbara had cash flows from financing activities to produce and sell 2,500 units to cover the factory expenditures and had to produce 3,500 units in order to meet her profit objectives. It’s the amount of sales the company can afford to lose but still cover its expenditures. Yes, the break-even point can change if your fixed or variable costs change, or if you change your pricing strategy.

Break-even analysis, or the comparison of sales to fixed costs, is a tool used by businesses and stock and option traders. It is essential in determining the minimum sales volume required to cover total costs and break even. By knowing the minimum number of units a company needs to sell to cover costs, businesses can set prices that ensure profitability while remaining competitive.

Effective marketing can increase user acquisition, potentially reducing the break-even time frame. Conducting sensitivity analysis can guide strategic decisions and risk management. User retention affects the lifetime value of a customer, which in turn impacts revenue per download. The time frame to reach the break-even point can vary significantly, often ranging from 6 months to 2 years. These costs can be estimated as a percentage of revenue, often ranging from 5% to 10%. These costs are typically incurred upfront and can range from $10,000 to $100,000 depending on the complexity of the app.

Leave a Comment