The newest ‘Newly opened’ loss, at the same time, can tell you the brand new of those internet sites. These are usually merely starting that will features several racy proposes to take advantage of, even when they might not have a get yet. The new ‘All’ loss near to it does draw up a complete set of sites, when chosen. To make an excellent PIN Debit put by send, make out a check otherwise currency buy and be sure in order to are the inmate name/ID and facility term. AdvancePayTo create an enthusiastic AdvancePay payment because of the post, find out a check or currency order payable so you can “AdvancePay Solution Service” and be sure to include your bank account count. You’re enjoying Costs and you will Terms & Conditions applicable to your state besides where you live.

Try the web-site: Help with analysis defense

Precisely endorsing a check for cellular put can aid in reducing the possibility of your own put’s getting declined. You’ll need to pursue such regulations whether or not your’re also preparing a personal take a look at, a certified take a look at or a mobile put cashier’s take a look at. Even if bucks dumps commonly a powerful fit to own on the internet banking companies, great cost and you will shortage of charge get more make up for it. Besides the processing cutoff moments, there are several whatever else could easily apply to just how a lot of time it takes for the money to appear on your membership. Thus, you’ll have the ability to pay by cellular when you have a SIM cards out of EE, Vodafone, O2, Around three or Virgin Mobile, and also the techniques is the identical, whatever the circle their mobile device is found on. There’s great news with regards to practical question of which cellular phone networks deal with spend-by-cellular places, as the all of the significant operastors in the uk create.

The Benefits and drawbacks out of Online casino Gambling Which have Payforit

There are numerous benefits associated with playing in the online slots shell out from the cellular phone statement websites. Additional big advantage is that you don’t need to enter people economic information from the internet casino and therefore you take pleasure in high financial shelter. You’ll found a contact verification once a cellular Deposit features already been registered. An additional current email address was made in the event the put could have been analyzed to let you know the new position of one’s deposit. An endorsement email address doesn’t make sure the money come instantly.

Deposit consumption bucks on the inmate’s faith membership in the reservation

The easiest method to see if your financial organization offers cellular cheque deposit would be to cheque their banking application otherwise call the lending company or borrowing from the bank relationship. There are numerous causes you might use your bank’s mobile cheque deposit ability, beginning with comfort. Deposit cheques using your mobile device could be a lot more accessible and you will a shorter time-ingesting than just riding to help you a part otherwise Atm.

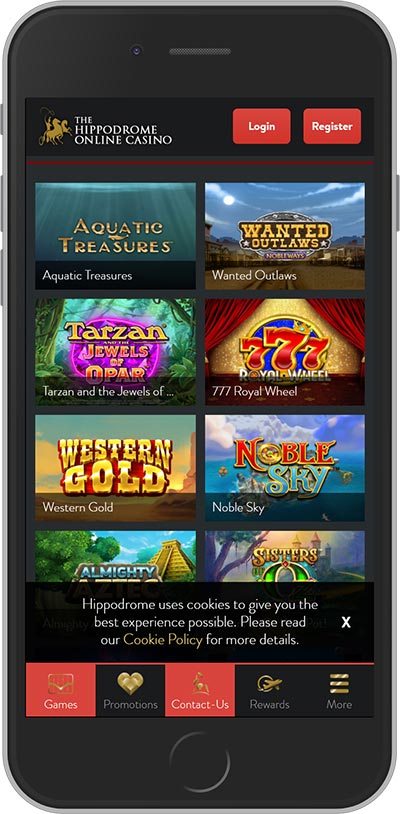

If not require casino expenses to look on the financial account/cards (but do not head them getting in your mobile phone bill!), you may be forced to adopt it as a deposit option. Spend because of the cell phone during the online casinos is frequently used to build places. Rather than a bank checking account or charge card, you can make in initial deposit making use of your most recent label credit. The key benefit of this method is you do not you want a charge card or a checking account to help you play in the an on-line gambling establishment. Easier than simply bucks and you may monitors — money is deducted from the comfort of your company checking account.

Any item that we come back to you are returned within the the form of a photograph from an IRD. Resources and you may Application Requirements.You are responsible for the safety of your try the web-site Capture Device, and making it possible for the only use by the anyone authorized by you. Your invest in apply and maintain interior shelter controls to safeguard the brand new Get Equipment and customer guidance. You’re accountable for all will set you back of using this service membership and working the fresh Take Unit, and, however limited to mobile and you can websites costs. You are responsible for maintaining the fresh bodies capacity and you may connectivity expected for use of your Provider.

While the a government, you could begin depositing cheques because of ATB Company cellular app proper aside. Exactly like costs repayments and transmits entitlements, you can offer permission for the users because of ATB Internet business. We see zero factors don’t bet by the mobile phone expenses at the the very least once. If you are Elizabeth-wallets usually obtain the nod, it commission system is since the secure because will get when you are future with an array of benefits. You could claim added bonus now offers inside and you may wager on the new most significant sports books in the business, therefore we can not recommend they any longer.

Qualifications to have PNC Secluded Put are at the mercy of lender approval. PNC Secluded Put eliminates need to transport paper monitors to the newest part and you will uses investigation signal in order to PNC. The system prevents multiple dumps from a check, as a result of content identification, and provides pages which have two amounts of shelter, to assist leave you satisfaction. Be mindful of it gambling enterprise, as it may introduce pay because of the mobile phone expenses put alternatives in the the near future, therefore it is a glamorous option for mobile players. Bitcoin, Ethereum, and other cryptocurrencies are a different age electronic currency you to definitely some casino providers is turning to. Yet not, Us gambling enterprises mainly avoid giving such percentage tips due it inside-condition laws.

- You should pertain within the-store at any PayJoy accepted provider.

- Almost any count you devote for your requirements is really what might possibly be taken from your following cellular telephone expenses.

- Nevertheless they are not processed if the take a look at numbers are very different or if the new penmanship is illegible.

- SoFi also provides an aggressive APY for the one another checking and you can savings accounts, in addition to an ample signal-upwards extra.

- It’s crucial that you learn how to availability and you will manage this type of pending places within the app, making sure your own money is actually securely taken into account and you can accessible to fool around with when needed.

- There are many different various ways to put through your smartphone bill.

- Extremely gambling enterprises obtained’t costs a lot more charges to possess PayPal dumps or distributions.

When you attend go into your own take a look at, the brand new software can tell you the most you could put. If you want to deposit an expense that’s over the new limit, go to a twigs or ATMs. Make sure you keep your sign in a safe place until you comprehend the full put matter placed in your bank account’s past/recent transactions. Opinion every piece of information you submitted to make certain that it’s exact. Submit the view and you can watch for verification to find out if it is accepted.

As mentioned over, because you put a check via your bank’s mobile software doesn’t mean you could put from look at. Even when your cellular deposit appears to come-off instead of a good hitch, it does be smart to keep the brand new paper look at once they clears, and when indeed there’s an issue afterwards. For a mobile view deposit to be processed, it must be rightly recommended. For those who’re not following regulations—signing it and you can writing particular type of “for mobile put merely” on the back—next there’s a spin the new deposit might possibly be declined. You’d have to redeposit the brand new look at, that can add to the waiting date up until it clears their membership.

Mobile view transferring allows a consumer to save efforts by depositing a check remotely on their smartphone due to a great bank’s cellular software. For security grounds, of several banking institutions restrict extent you can put remotely. See just what your financial’s every day and you can monthly mobile deposit constraints is, following concur that their consider number is within the individuals restrictions.

Make sure you understand regards to the fresh deposit, keep them written down, and simply think in initial deposit when you are purchased to shop for the automobile. Leaving in initial deposit offers a risk of a primary loss, however, often it is to your own benefit to set-aside the brand new vehicle. For in initial deposit to be a good idea, you truly must be most specific you are ready to buy the fresh automobile.

Extremely banking institutions give quick mobile take a look at deposits nowadays, enabling you to rapidly and you can easily cash a check to your family savings by studying it together with your mobile. However, even if available, only a few cellular look at dumps are offered with similar terms and you may conditions, and then make specific banking institutions a lot more ample than the others. Although not, shell out from the cellular telephone is intended if you don’t have credit cards otherwise a bank checking account. It is geared towards electronic inclusion, which allows probably the unbanked to enjoy casino games. The situation of a-south African gambling enterprise percentage perspective is that really web based casinos do not currently undertake spend by the cellular phone.